NOTE 1: STATEMENT OF SIGNIFICANT ACCOUNTING POLICIESThis financial report is a special purpose financial report prepared for use by the members of the committee.

The members have determined that the entity is not a reporting entity. The financial report has been prepared in accordance with the requirements of the following Australian Accounting Standards:

AASB 1031: Materiality

AASB 110: Events Occurring After Reporting Date

No other applicable Accounting Standards or mandatory professional reporting requirements have been applied.

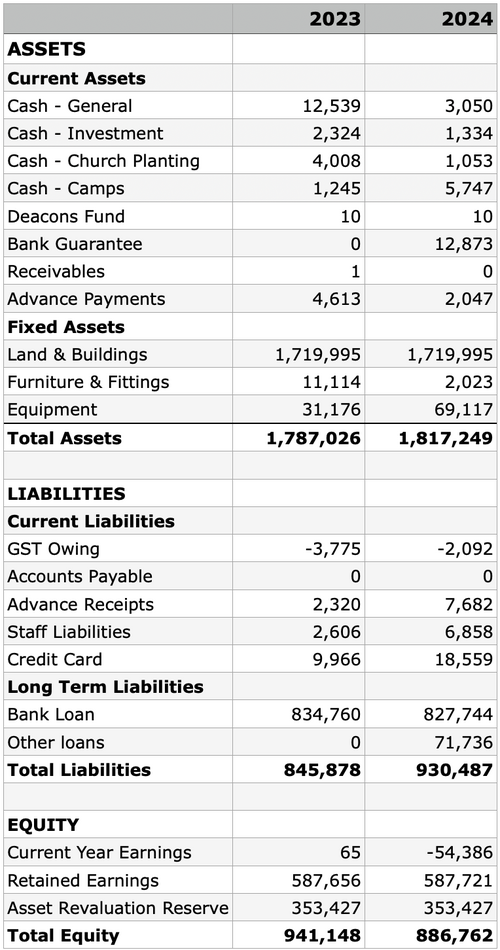

The statements are prepared on an accrual basis. They are based on historic costs and do not take into account changing money values or, except where specifically stated, current valuations of non-current assets.

The following specific accounting policies, which are consistent with the previous period unless otherwise stated, have been adopted in the preparation of these statements:

(a) Revenue Recognition

Revenue is measured at the fair value of the consideration received or receivable. Amounts disclosed as revenue are net returns, trade allowances, rebates and amounts collected on behalf of third parties.

Donations are recognised as received from the Church members. No receivable exists for donations.

(b) Income Tax

The activities of the entity are exempt from taxation under Sec 50-5 of the Income Tax Assessment Act 1997.

(c) Cash and cash equivalent

Cash and cash equivalent includes deposits held at call with financial institutions, other short- term, highly liquid investments that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in values, and bank overdrafts.

(d) Property, Plant and Equipment

Property, Plant and Equipment are stated at historical cost less depreciation. Historical cost includes expenditure that is directly attributable to the acquisition of the items. Subsequent costs are included in the asset’s carrying amount or recognised as a separate asset, as appropriate, only when it is probable that future economic benefits associated with the item will flow to the association and the cost of the item can be measured reliably.

(e) Goods and Service Tax (GST)

Revenues, expenses and assets are recognised net of the amount of associated GST, unless GST incurred is not recoverable from the taxation authority. In this case, it is recognised as part of the cost of the acquisition of the asset or as part of the expense.

(f) Building Lease Income:

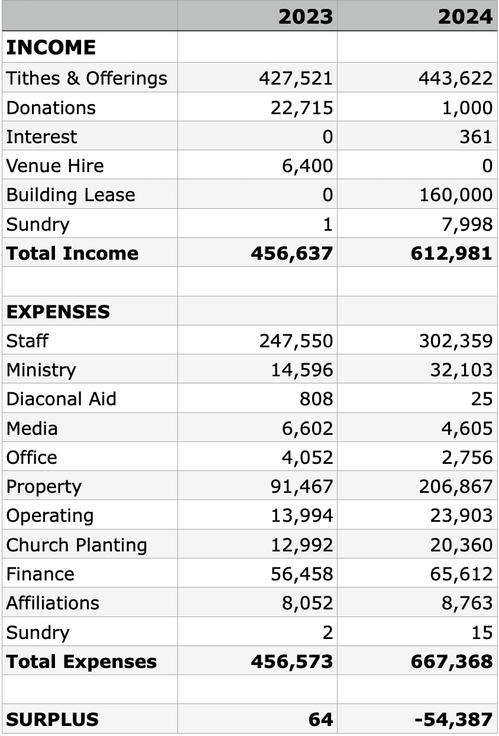

During the year, the church leased the Springfield lakes property on lease for a term of 3 years from 1 May 2024. The lease income received till 31 December 2024 was $ 160,000